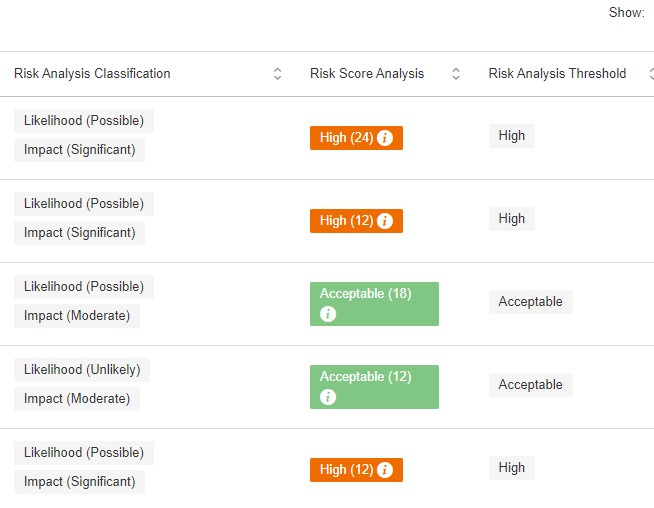

Hi, I’m just getting to grips with eramba. As part of my investigations I’ve created a few asset based risks. I’ve noticed that the Risk Score Analysis column shows the numerical result of the risk calculation (likelihoodimpact)(liability factor). But the threshold value and background colour shown for a risk takes no account of the liability factor. This means a risk with a score of 18 (33)(2) is shown in green as Acceptable while a risk with a lower score of 12 (3*4) but no liability factor is shown as High risk in red. As a (naive) user I was expecting the threshold value calculation to take account of the liability factor. Is there a particular reason why it doesn’t work that way?

In the current version, the default “Threshold” analysis simply looks at the intersection of the two values that you’re using to rate the risk (i.e. Likelihood and Impact) and spits out a result per the table that you completed.

From a risk score perspective, there is the “Numerical” configuration, but that is more of a “is the risk above or below my appetite?” sort of thing.

One of the challenges with the use of the score to determine your “Analysis” risk rating is that your scale can go sideways fairly quickly - adding multiple liabilities can easily stack and make results seem weird - I would assume that is why it is like it is…

I’d say if you want to leverage the risk score, look at using the Custom Status functionality (assuming you’re on Enterprise), and with that, you can set a status for the item based upon the calculated risk score meeting some criteria (less than/equal to/greater than).

Thanks for the advice and quick response David. You make a good point about things getting messy very quickly if you use multiple liabilities. I’ll have a think about how I can tweak our approach to make best use of the tool.